Earning season is a crucial time for investors. Companies release their financial results, and stock prices can swing dramatically. Knowing how to pick stock in earning season can help you make informed decisions and avoid costly mistakes.

This guide will walk you through the best strategies, key metrics to watch, and common pitfalls. Whether you’re a beginner or an experienced trader, these tips will sharpen your earning season stock-picking skills.

Table of Contents

Why Earning Season Matters for Stock Picking

Earning season happens four times a year when publicly traded companies report their quarterly results. These reports include revenue, profits, and future guidance—details that influence stock prices.

Here’s why earning season is important:

- Volatility increases – Stocks often move sharply based on earnings beats or misses.

- Opportunities arise – Strong results can signal a great buying opportunity.

- Trends become clear – You can spot which sectors are performing well.

Learning how to pick stock in earning season helps you capitalize on these movements.

Key Metrics to Analyze Before Buying Stocks

Not all earnings reports are equal. Focus on these critical metrics to make smarter choices:

1. Earnings Per Share (EPS)

- Measures a company’s profitability.

- Compare actual EPS vs. analyst estimates.

- A positive surprise often boosts stock prices.

2. Revenue Growth

- Shows if sales are increasing.

- Look for consistent year-over-year growth.

3. Guidance & Outlook

- Future projections matter more than past performance.

- Weak guidance can sink a stock, even with good earnings.

4. Profit Margins

- High margins mean better efficiency.

- Declining margins may signal trouble.

5. Price-to-Earnings (P/E) Ratio

- Helps determine if a stock is overvalued.

- Compare with industry peers.

Using these metrics is essential when figuring out how to pick stock in earning season.

Step-by-Step Strategy to Pick Winning Stocks

Step 1: Identify High-Probability Candidates

- Look for companies with a history of beating earnings.

- Focus on sectors with strong momentum (e.g., tech, healthcare).

Step 2: Analyze Pre-Earnings Price Action

- Stocks often rally before earnings due to optimism.

- Be cautious—overbought stocks may drop after results.

Step 3: Check Insider & Institutional Activity

- Insiders buying shares before earnings is a bullish sign.

- Hedge funds increasing positions can indicate confidence.

Step 4: Review Analyst Upgrades/Downgrades

- Upgrades suggest strong potential.

- Downgrades may signal upcoming weakness.

Step 5: Plan Your Entry & Exit

- Set buy limits to avoid chasing prices.

- Use stop-loss orders to protect against downside.

Following these steps will improve your approach to how to pick stock in earning season.

Common Mistakes to Avoid

Even experienced investors make errors during earning season. Avoid these pitfalls:

❌ Buying Based Only on Past Performance – Future outlook matters more.

❌ Ignoring Guidance – Weak projections can erase short-term gains.

❌ Overlooking Sector Trends – A strong company in a weak sector may still struggle.

❌ FOMO (Fear of Missing Out) – Don’t chase stocks after a huge rally.

❌ Not Using Stop-Losses – Protect yourself from sudden drops.

Sticking to a disciplined strategy is key when learning how to pick stock in earning season.

Best Sectors to Watch During Earning Season

Some industries tend to have more predictable earnings patterns:

✔ Technology – Growth stocks often see big moves.

✔ Consumer Discretionary – Spending trends impact earnings.

✔ Healthcare – Stable demand, especially in pharma.

✔ Financials – Banks report early, setting market tone.

✔ Energy – Oil prices heavily influence earnings.

Focusing on these sectors can refine your stock selection process.

Final Thoughts

Earning season offers great opportunities if you know how to pick stock in earning season wisely. By analyzing key metrics, following a structured strategy, and avoiding common mistakes, you can make better investment decisions.

Want to stay ahead? Bookmark this guide and revisit it before the next earning season.

Engagement Question:

What’s your biggest challenge when picking stocks during earning season? Let me know in the comments!

Search VIP at Counzila Search Box Here If You Like to Learn More…

Go here search news vip these new search ideas

- Best stocks to buy before earnings report (Informational)

- Earnings season trading strategies (Transactional)

- How to analyze earnings reports for stocks (Informational)

- Top sectors during earning season (Informational)

- EPS vs. revenue: which matters more? (Informational)

- Earning season volatility explained (Informational)

- How insider trading affects earnings (Informational)

- Stock price reaction to earnings surprises (Informational)

- Earning season mistakes to avoid (Informational)

- When to sell stocks after earnings (Transactional)

This guide gives you everything you need to master how to pick stock in earning season. Happy investing! 🚀

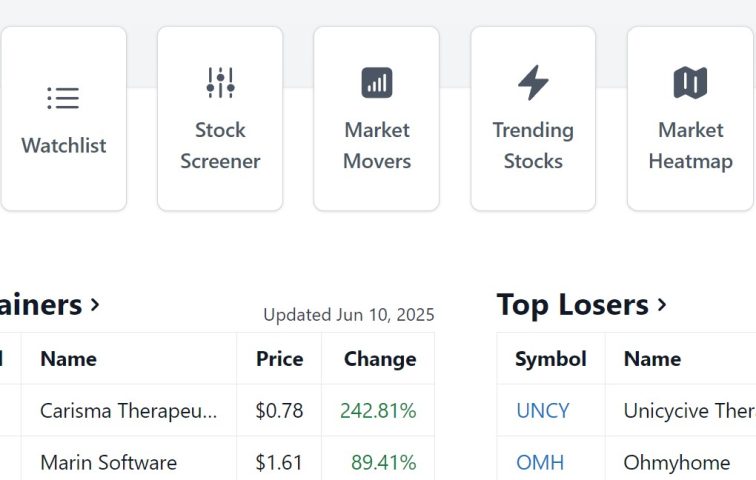

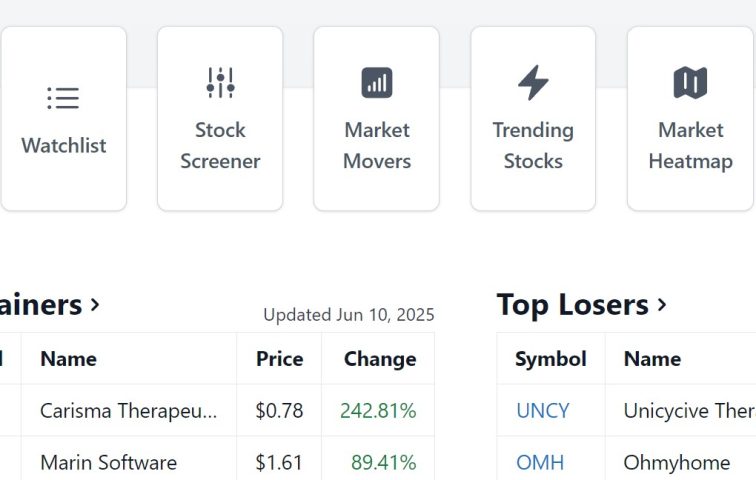

Using TradingView for Stock Picking During Earnings Season

Earning season demands quick analysis and smart decision-making. A powerful tool like TradingView ( official site find below) can help you scan, analyze, and trade stocks efficiently. This section covers how to use TradingView’s stock screens and charting tools to pick winning stocks during earnings season.

Why TradingView is a Game-Changer for Earnings Season

TradingView is a popular platform among traders for its:

✔ Real-time data – Track live stock movements.

✔ Advanced charting – Spot trends with technical indicators.

✔ Stock screening – Filter stocks based on earnings-related metrics.

✔ Social community – See what other traders are discussing.

Using TradingView can streamline your process when learning how to pick stock in earning season.

Best TradingView Stock Screens for Earnings Season

1. Earnings Date & Expectations Filter

- Set a filter for companies reporting earnings in the next week.

- Compare analyst estimates vs. previous results.

2. High EPS Growth Stocks

- Screen for companies with consistent EPS growth.

- Look for stocks where EPS is expected to rise sharply.

3. Revenue Beat Potential

- Find companies with strong revenue trends.

- Focus on those likely to surpass expectations.

4. Low P/E Stocks with Upcoming Earnings

- Identify undervalued stocks before earnings.

- Helps find potential breakout candidates.

5. Insider Buying Before Earnings

- Use insider transaction data to spot bullish signals.

- Heavy buying before earnings can indicate confidence.

These screens help you quickly find high-potential stocks when figuring out how to pick stock in earning season.

Using TradingView Charts for Earnings Trades

1. Pre-Earnings Breakout Patterns

- Look for ascending triangles or bullish flags before earnings.

- Breakouts often lead to strong post-earnings rallies.

2. Volume Spikes Before Reports

- Unusual volume surges may hint at institutional interest.

- High volume + price rise = potential bullish momentum.

3. Support & Resistance Levels

- Identify key price levels where stocks may bounce or drop.

- Helps set entry and exit points before volatility hits.

4. RSI & MACD for Momentum

- RSI above 70 = Overbought (caution before earnings).

- MACD crossover = Potential trend reversal signal.

5. Post-Earnings Gap Analysis

- Stocks often gap up or down after earnings.

- Use gap strategies (fade or follow) based on market reaction.

Mastering these charting techniques sharpens your approach to how to pick stock in earning season.

TradingView Alerts for Earnings Season

Set up custom alerts to stay ahead:

🔔 Earnings Date Reminders – Never miss a report.

🔔 Price Breakout Alerts – Get notified if a stock crosses key levels.

🔔 Volume Spike Notifications – Spot unusual activity early.

Automating these alerts saves time and keeps you disciplined.

FAQ: How to Pick Stock in Earning Season

1. When is the best time to buy stocks before earnings?

- Ideally, 1-2 weeks before earnings to avoid last-minute volatility.

- Watch for bullish chart patterns and insider buying.

2. Should I hold a stock through earnings?

- It depends on your risk tolerance. Earnings can cause big swings.

- If you’re unsure, consider taking partial profits before the report.

3. How do I know if earnings will beat expectations?

- Track analyst estimate revisions leading up to earnings.

- Look for positive guidance and insider buying.

4. What’s the biggest mistake traders make during earnings season?

- Chasing stocks after a big move (FOMO).

- Ignoring guidance and only focusing on past results.

5. Can TradingView predict earnings outcomes?

- No, but it helps analyze trends, volume, and sentiment.

- Combine it with fundamental research for better accuracy.

6. Which technical indicators work best for earnings trades?

- RSI (overbought/oversold levels).

- MACD (momentum shifts).

- Volume analysis (institutional interest).

7. How do I avoid earnings-related losses?

- Use stop-loss orders.

- Diversify instead of betting heavily on one stock.

- Wait for post-earnings price stabilization before entering.

Ready to test these strategies? Open TradingView, set up your screens, and start analyzing!

Question for You:

Do you prefer trading before, during, or after earnings? Share your approach below! 🚀