Investing in dividend growth stocks can be a smart way to build passive income. But finding undervalued stocks with strong dividend growth potential isn’t always easy. If you’re wondering how to find cheap dividend growth stocks, this guide will walk you through proven strategies to spot them.

Table of Contents

Why Focus on Cheap Dividend Growth Stocks?

Cheap doesn’t mean low quality. A cheap dividend growth stock is one trading below its true value while still increasing payouts over time. Here’s why they’re worth considering:

- Higher yields at lower prices – Buying undervalued stocks means you lock in better dividend yields.

- Long-term compounding – Reinvesting dividends from growing payouts accelerates wealth.

- Margin of safety – Lower prices reduce downside risk if markets dip.

Now, let’s dive into how to find cheap dividend growth stocks effectively.

1. Look for Consistent Dividend Growth

A strong track record matters. Companies that raise dividends yearly are more reliable. Here’s what to check:

- 5+ years of consecutive dividend increases – Shows commitment to shareholders.

- Sustainable payout ratio (below 60%) – Ensures dividends aren’t eating all profits.

- Earnings growth – Dividends should grow alongside company profits.

Stocks with these traits often keep rewarding investors.

2. Screen for Undervalued Stocks

Finding cheap dividend growth stocks requires filtering for value. Use these metrics:

- Low P/E ratio (under 15) – Indicates the stock may be undervalued.

- Price-to-Book (P/B) below 1.5 – Suggests the stock trades below its book value.

- Dividend yield above sector average – Higher yield at a lower price is ideal.

Free stock screeners (like Finviz or Yahoo Finance) can help spot these opportunities.

3. Focus on Strong Free Cash Flow

Dividends come from cash flow. A company must generate enough to keep paying and raising dividends. Look for:

- Free cash flow (FCF) covering dividends – FCF should exceed dividend payments.

- Growing FCF over time – Ensures future hikes are possible.

Avoid companies with declining cash flow—they may cut dividends later.

4. Check for Reasonable Debt Levels

Too much debt risks dividend cuts during downturns. Key debt metrics:

- Debt-to-Equity ratio below 1.0 – Lower debt means less financial strain.

- Interest coverage ratio above 3x – Shows earnings can cover interest payments.

Financially stable companies are safer bets for cheap dividend growth stocks.

5. Study Industry Trends

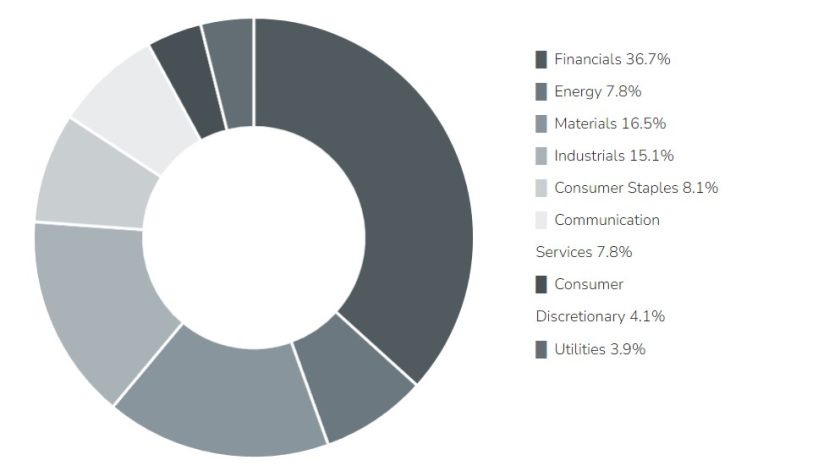

Some sectors are better for dividend growth than others. Consider:

- Utilities & Consumer Staples – Steady demand supports stable dividends.

- Healthcare & Financials – Often have strong cash flows for payouts.

- Avoid cyclical industries – Dividends may suffer in economic downturns.

Picking the right sector improves your chances of finding cheap dividend growth stocks.

6. Analyze Dividend Safety Scores

Some research tools (like Simply Safe Dividends) rate stocks based on payout safety. Look for:

- Scores of 60+ (out of 100) – Indicates a secure dividend.

- No recent dividend cuts – A red flag if payouts have been reduced.

This extra check helps avoid risky picks.

7. Watch for Market Overreactions

Sometimes solid stocks drop due to short-term fears, creating buying opportunities. Watch for:

- Temporary bad news (earnings miss, lawsuit) – If fundamentals remain strong, the stock may rebound.

- Sector-wide selloffs – Can drag down good stocks unfairly.

Patience helps you grab cheap dividend growth stocks at a discount.

8. Reinvest Dividends for Faster Growth

Compounding boosts returns over time. Reinvesting dividends means:

- Buying more shares at lower prices – Increases future payouts.

- Accelerating wealth growth – Small reinvestments add up significantly.

Set up a DRIP (Dividend Reinvestment Plan) to automate this process.

9. Avoid High-Yield Traps

A sky-high yield isn’t always good. Some red flags:

- Yield over 8-10% – Often unsustainable or tied to a falling stock price.

- Payout ratio above 100% – Means dividends exceed earnings.

Stick with moderate yields (3-6%) from financially healthy companies.

10. Stay Patient & Diversify

Building a portfolio of cheap dividend growth stocks takes time. Follow these rules:

- Buy in batches – Avoid putting all money in at once.

- Spread across sectors – Reduces risk if one industry struggles.

- Hold long-term – Dividend growth works best over years.

Final Thoughts

Learning how to find cheap dividend growth stocks takes research, but the rewards are worth it. By focusing on strong fundamentals, value metrics, and dividend safety, you can build a portfolio that grows income over time.

Now it’s your turn!

What’s your favorite dividend growth stock right now? Let us know in the comments!

Want more investing tips?

Subscribe for weekly insights on building wealth through smart dividend investing!

Search VIP at Counzila Search Box Here If You Like to Learn More…

- Best undervalued dividend stocks

- High-growth dividend-paying companies

- How to pick dividend stocks for long term

- Cheap stocks with rising dividends

- Top dividend growth ETFs

- Dividend reinvestment strategy

- Safe dividend stocks to buy now

- How to analyze dividend safety

- Best sectors for dividend investing

- Low P/E dividend stocks

This guide gives you a clear path to finding cheap dividend growth stocks. Start screening today and build a stronger income portfolio!

Using Wealthsimple to Find the Best Dividend Growth Stocks

If you’re looking for an easy way to find cheap dividend growth stocks, Wealthsimple is a great platform to consider. This user-friendly investing app helps beginners and experienced investors discover high-quality dividend stocks without complex analysis. Here’s how you can use Wealthsimple to build a strong dividend portfolio.

Why Wealthsimple is Great for Dividend Investors

Wealthsimple offers tools that simplify stock research, making it easier to spot cheap dividend growth stocks. Key benefits include:

- Low fees – No commission fees on stock trades, keeping costs down.

- Automated screening – Pre-built filters help identify dividend-paying stocks.

- Fractional shares – Invest in expensive stocks with small amounts of money.

- DRIP (Dividend Reinvestment Plan) – Automatically reinvest dividends to grow your holdings.

How to Find Dividend Growth Stocks on Wealthsimple

1. Use the Stock Screener Tool

Wealthsimple’s stock screener lets you filter stocks based on key dividend metrics:

- Dividend yield – Set a minimum threshold (e.g., 3% or higher).

- Dividend growth history – Look for companies with 5+ years of increases.

- Payout ratio – Filter for stocks with sustainable payouts (under 60%).

- Valuation metrics – Check P/E ratio, P/B ratio, and free cash flow.

This helps you quickly find cheap dividend growth stocks without manual research.

2. Explore Wealthsimple’s Pre-Built Dividend Portfolios

Wealthsimple offers curated portfolios, including dividend-focused ones. These are managed based on:

- Dividend consistency – Only stocks with long-term payout growth.

- Sector diversification – Spread across stable industries like utilities and healthcare.

- Risk-adjusted returns – Balanced for steady income with lower volatility.

If you prefer a hands-off approach, these portfolios can be a great starting point.

3. Leverage Research Reports & Insights

Wealthsimple provides analyst insights on stocks, including:

- Dividend sustainability scores – Checks if payouts are safe.

- Earnings growth projections – Helps predict future dividend hikes.

- Market trends – Identifies sectors with strong dividend potential.

Using these reports, you can make informed decisions on which cheap dividend growth stocks to buy.

4. Set Up Dividend Alerts

Wealthsimple allows you to track dividend stocks with notifications for:

- Ex-dividend dates – Ensures you buy before the cutoff.

- Dividend increases – Alerts you when companies raise payouts.

- Price drops – Flags buying opportunities during market dips.

This keeps you updated without constant manual checking.

5. Use Fractional Shares to Diversify

Some top dividend stocks trade at high prices (e.g., $100+ per share). Wealthsimple’s fractional shares feature lets you:

- Invest small amounts – Buy a portion of expensive stocks.

- Spread risk – Own multiple dividend payers without heavy capital.

- Reinvest efficiently – Put dividends into new stocks immediately.

This makes it easier to build a diversified cheap dividend growth stock portfolio.

Wealthsimple Trade vs. Wealthsimple Invest

Wealthsimple offers two main platforms for dividend investors:

| Feature | Wealthsimple Trade (Self-Directed) | Wealthsimple Invest (Robo-Advisor) |

|---|---|---|

| Control | Full control over stock picks | Automated portfolio management |

| Fees | $0 commission fees | 0.5% management fee |

| Dividend Reinvestment | Manual or DRIP-enabled | Automatic reinvestment |

| Best For | Active investors who pick stocks | Passive investors who want automation |

If you enjoy researching and selecting cheap dividend growth stocks yourself, Wealthsimple Trade is the better choice. If you prefer a hands-off approach, Wealthsimple Invest handles everything for you.

Tips for Maximizing Dividend Growth on Wealthsimple

To get the most out of Wealthsimple for dividend investing:

✅ Reinvest dividends automatically – Turn on DRIP to compound returns.

✅ Check the tax implications – Dividends are taxable; use TFSA or RRSP accounts for tax efficiency.

✅ Rebalance occasionally – Sell underperformers and add stronger dividend growers.

✅ Stay patient – Dividend growth investing works best over 5+ years.

Final Thoughts on Using Wealthsimple for Dividend Stocks

Wealthsimple makes finding cheap dividend growth stocks simple and affordable. Whether you prefer hands-on stock picking or automated investing, the platform provides the tools to build a strong income-generating portfolio.

Now it’s your turn!

Have you used Wealthsimple for dividend investing? Share your experience in the comments!

Want more dividend stock insights?

Subscribe for weekly tips on growing your passive income!

FAQ: How to Find Cheap Dividend Growth Stocks

1. What makes a stock a “cheap dividend growth stock”?

A cheap dividend growth stock is undervalued (low P/E, P/B ratios) but has a history of increasing dividends. It offers a good yield at a reasonable price with strong future payout potential.

2. How do I know if a dividend is safe?

Check:

- Payout ratio (below 60% is ideal)

- Free cash flow (should cover dividends)

- Debt levels (low debt reduces risk of cuts)

3. Can I find dividend stocks on free platforms?

Yes! Wealthsimple, Yahoo Finance, and Finviz offer free screeners to find cheap dividend growth stocks.

4. Should I focus on high-yield or high-growth dividends?

A mix is best. Look for moderate yields (3-6%) with consistent growth (5+ years of increases) for the best balance.

5. How often should I check my dividend portfolio?

Review quarterly when earnings are reported. Avoid over-trading—dividend investing rewards patience.

6. Are dividend stocks better in a TFSA or RRSP?

TFSA is best for Canadian dividends (tax-free). RRSP is better for U.S. stocks (avoids withholding tax).

7. What’s the best sector for dividend growth stocks?

Utilities, consumer staples, and healthcare tend to be the most reliable for long-term dividend growth.

8. Can I automate dividend investing on Wealthsimple?

Yes! Wealthsimple Invest automatically reinvests dividends. Wealthsimple Trade allows DRIP setups.

9. How much should I invest in dividend stocks?

Start with at least 5-10 stocks across different sectors to reduce risk.

10. Do I need a lot of money to start dividend investing?

No! With fractional shares, you can start with as little as $1 per stock.

By following these strategies and using Wealthsimple’s tools, you can build a powerful cheap dividend growth stock portfolio that generates passive income for years. Happy investing! 🚀

Disclaimers: The information provided in this article by Counzila is based on independent research and publicly available data. Pricing, features, platforms policies & data may change over time. Always verify details directly with the provider before making decisions. This content is for informational purposes only and does not constitute financial or legal advice.

Please note that some links in this guide may be partner links, meaning Counzila may earn a commission if you choose to use these services. This comes at no additional cost to you and helps support our research.